IMF released its January 2024 World Economic Outlook. You may also read the Full Report.

What you will notice in the report is that inflation is declining. supply chain issues linger, geopolitical issues (could impact influence and trade), cost of borrowing is still high, etc. are contributing to the economy both positively and negatively. We often think of things in isolation but in the realities of life there are many factors that contribute to overall economic health. Once we understand the market we can improve the ability to meet those market challenges.

The overview from the report....

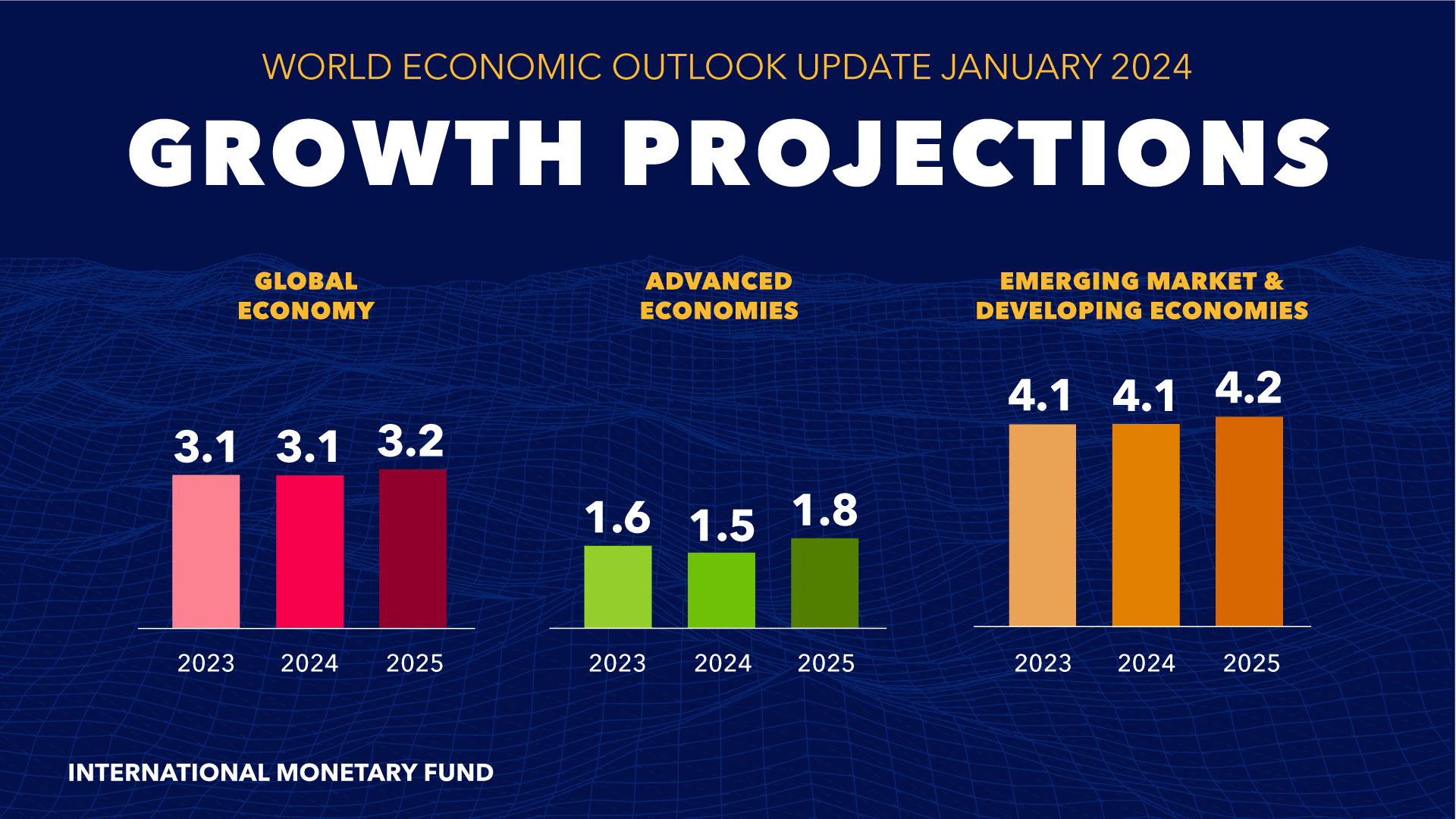

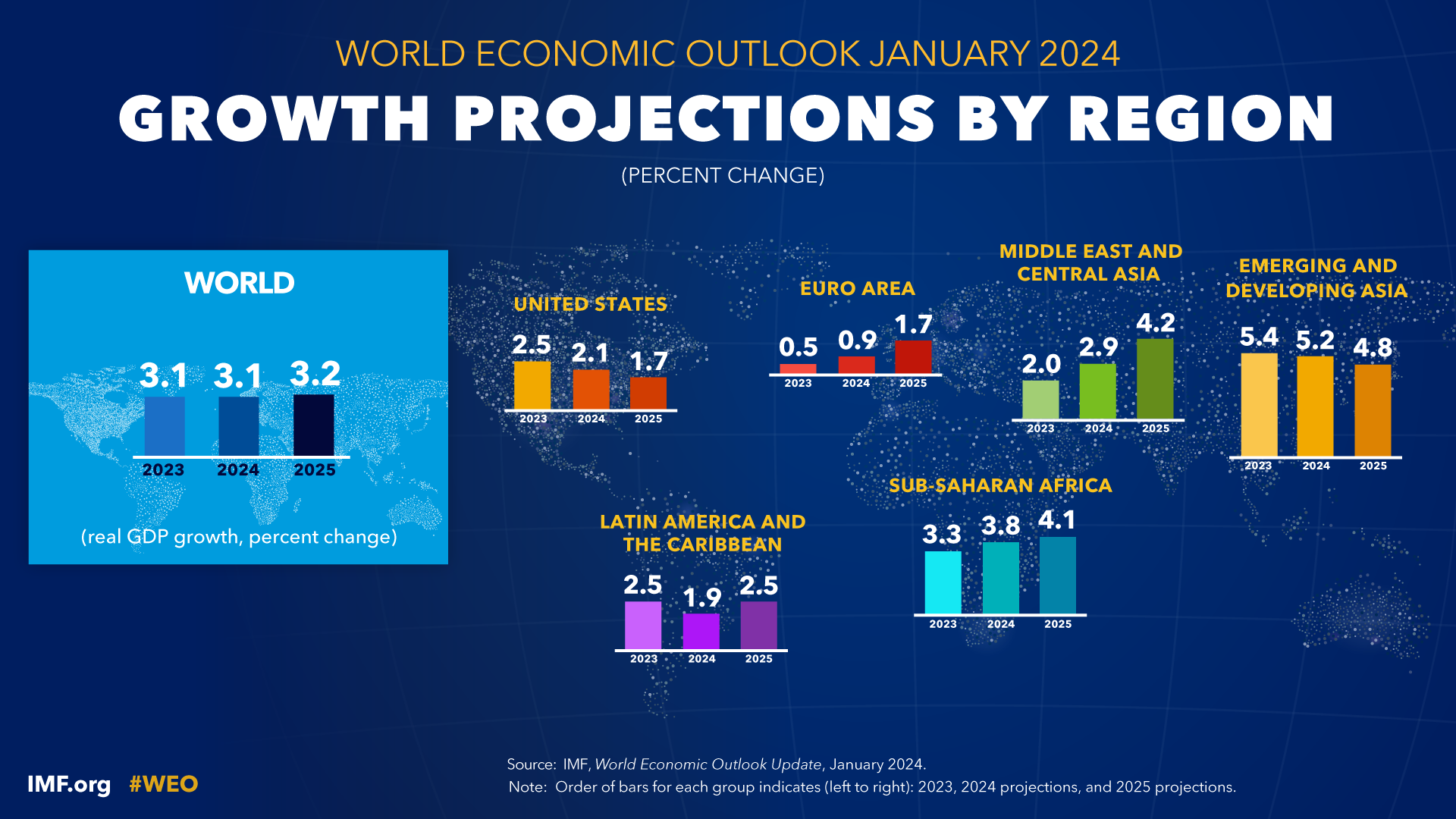

"Global growth is projected at 3.1 percent in 2024 and 3.2 percent in 2025, with the 2024 forecast 0.2 percentage point higher than that in the October 2023 World Economic Outlook (WEO) on account of greater-than-expected resilience in the United States and several large emerging market and developing economies, as well as fiscal support in China. The forecast for 2024–25 is, however, below the historical (2000–19) average of 3.8 percent, with elevated central bank policy rates to fight inflation, a withdrawal of fiscal support amid high debt weighing on economic activity, and low underlying productivity growth. Inflation is falling faster than expected in most regions, in the midst of unwinding supply-side issues and restrictive monetary policy. Global headline inflation is expected to fall to 5.8 percent in 2024 and to 4.4 percent in 2025, with the 2025 forecast revised down."

No comments:

Post a Comment