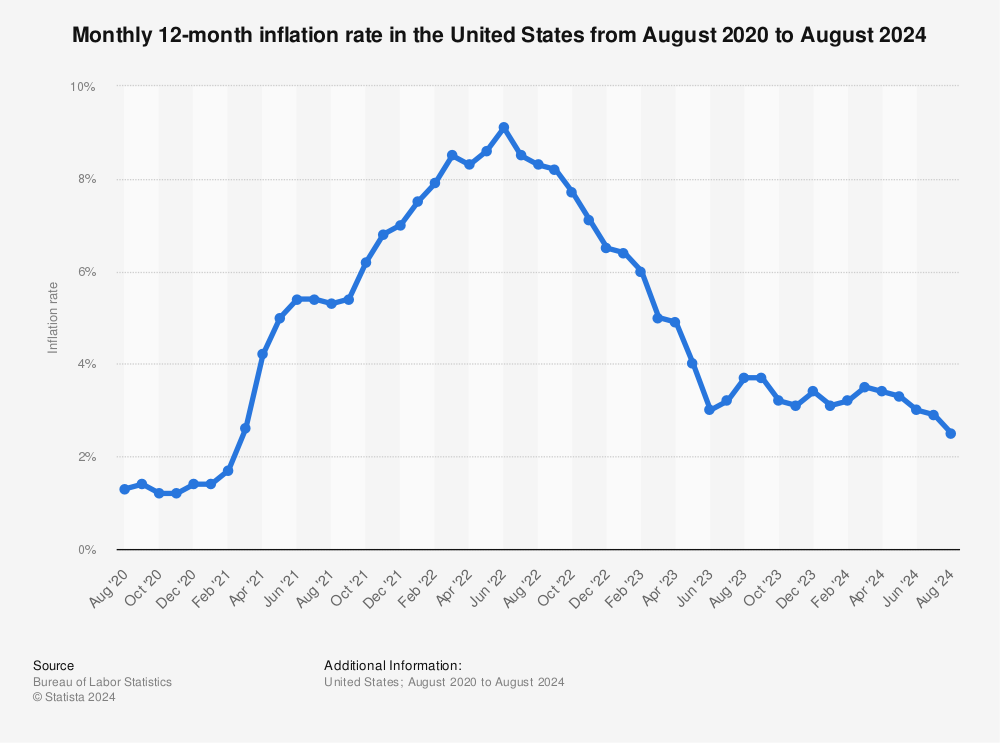

Everyone is talking about the economy and inflation and it seems to be one of the biggest discussions out there. Typically, as prices goes up it is a sign that inflation is also going up. In September we can see that prices went up a touch and that has not prompted a significant policy change. Bond markets are also becoming more volatile and supply chain issues. Nothing appears truly decisive so a wait and hold strategy might sense. You may want to read Janet Yellen October Receipts, Outlays, Deficits

Personally, I'm going to just look at the long term and not the short term. Balanced budget, reasonable cash reserves and putting money in long term investments. Don't take that as advice because that is just what I'm going to do. I'm not that smart because lots of complex conversations out there. For the little people we don't have millions and billions but we can sort of do the best we can with what we have.

If we could get government (everyone) to balance the budget and think about paying down long term debt we might be getting somewhere. That likely comes with a cost as well. The vast majority of us are living pay check to pay check. Government sort of lives pay check to pay check and borrows a little from the future increasing longer term problems. Perhaps an overhaul of expenditures and ensuring programs are efficient and effective would help.

Find more statistics at Statista

No comments:

Post a Comment