(I think China used a more Communist approach of top down management which pushed growth but may not work well in to the next era. This is interesting to see if U.S. innovative push will further encourage longer term upward US growth that could outstrip China's in a few years. I'm thinking about 23/24 as being a type of transition time. One might even wonder if we are entering into a new digital platform homeostasis. There is a prediction of a recession this year so we will have to see if that plays out. Likewise China is expected to rise next quarter. However, numbers haven't been following traditional patterns as they should. It means there is likely an extraneous confounding variable our analysts haven't found. I would think perhaps more or less lots of digital transactions that are not being covered well under traditional metrics making the variability range much higher than normal. I could be 100% wrong about it, that is ok.)

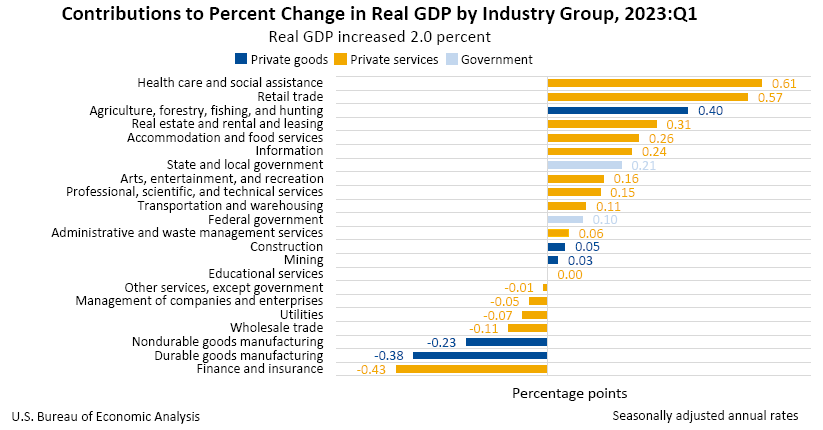

Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, First Quarter 2023A couple of key points.....(quoted)...

-The increase in real GDP in the first quarter reflected increases in consumer spending, exports, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by decreases in private inventory investment and residential fixed investment. Imports increased (table 2).

Fox News has some interesting information GDP increased in Q1 2023, but experts forecast recession

You can Federal Chair Jerome Powell's discussion June 14th, 2023 Federal Reserve Transcript.

No comments:

Post a Comment