|

| Inflation impacts energy and fuel. That is when you need a sail boat versus motor boat. |

One of the reasons why you may want to read these reports is because they offer key insights into things that are happing now and things that may happen in the near term. As you browse some of the highlights below you will also notice discussions on leading issues of the day and a few projections that business executives, leaders, and investors might want to explore. I read them to not only understand the world markets but also the larger system. (and of course myself...and I'm not very rich. I was working a long time on a different sort of thing so I'm kind of new to the game here. If you scratch beyond the surface of our assumptions there are whole worlds of different things to explore. Not specifically related but our brains are programed through culture to see only certain things and thus we miss out on lots of different perspectives outside our perceptional understanding. There is data we take from our senses and there is the understanding of that information based on cultural programming. Different cultures and peoples will see different things in the same phenomenon.)

In addition, to relevant policy setting discussions, the IMF also publishes root information based on seminal types of economic research. This means that other people read this and publish their own news articles and opinion pieces. The core information is in the data and within the narrative of the report. Sometimes you can look at the data and see a few things that they may not have mentioned or may have even missed (It should be stated that in science there are a few decision makers and lots of indoctrination on what types of problems to look at the the methods used to decode and organize data. To know that for sure someone would need to look at the backgrounds of key leaders, higher education institutions, professors and the major economic philosophies at the time of their attendance as obtained through syllabus, academic departments, etc.... Creative mindsets free flow connections beyond economic formulas and statistics. Some of this limiting scope is from the exact nature of economic calculations seeking to imperfectly explain the neuroeconomic choices of human behavior; even harder if we don't have strong virtual economic models in a world where increasingly more choices are made online without the same physical constraints. This means that the highest positions in government decision making are regularly awarded to people who attended the best schools and in turn their indoctrination limits their ability to see "out of the box" phenomenon and/or solutions. Learning organizations should think about the different types of people, various backgrounds, that can see things in new ways but have enough industry knowledge to make recommendations useful. What I'm saying isn't specific to the IMF but to all agencies in the sense of key leadership teams and their educational backgrounds.. Diversity of thought is beneficial for strategic planning. Science Starts with Question)

A few key points from the report........

1. Supply disruptions, higher energy costs, and reduction of fiscal policy (we should expect this) have reduced downward the U.S. GDP 1.2 percentage-points.

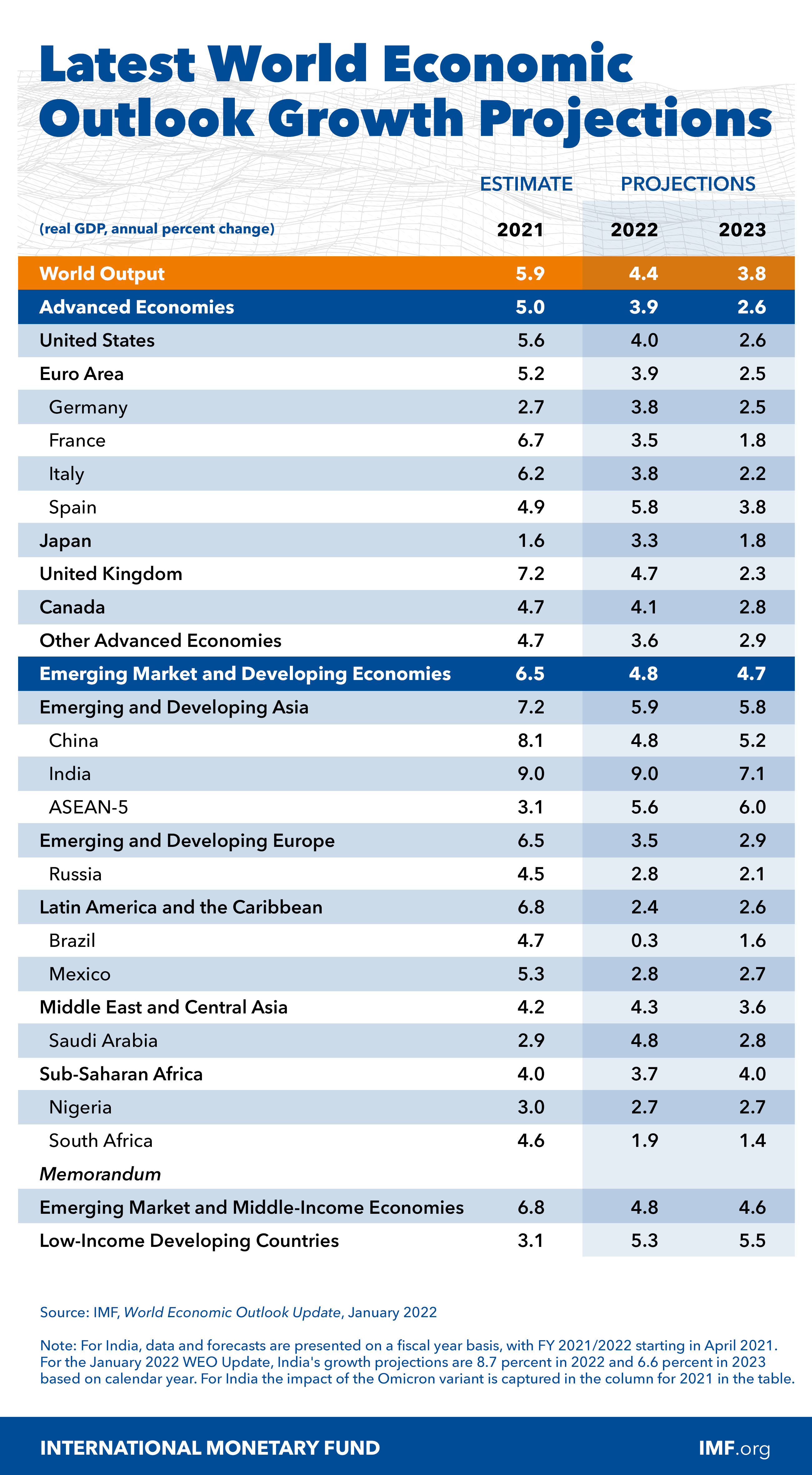

2. Global Economy moves from 5.9 in 2021 to 4.4 percent in 2022 (Remember its a market projection)

3. Global growth is expected to be around 3.8 percent in 2023 (Remember its a market projection)

1. Supply disruptions, higher energy costs, and reduction of fiscal policy (we should expect this) have reduced downward the U.S. GDP 1.2 percentage-points.

2. Global Economy moves from 5.9 in 2021 to 4.4 percent in 2022 (Remember its a market projection)

3. Global growth is expected to be around 3.8 percent in 2023 (Remember its a market projection)

4.Inflation will decline when supply chains return back to normal (We adapt. If the U.S. starts drawing back investment, manufacturing and supply chains it can reduce long term inflation threats like this. Reduce but not eliminate is the key term. In the Digital Era we have better metrics and can see emerging economic threats happen.. We are also more connected to global economies but also have better tools and ability to navigate economic storms. For example, our government might find the right calibrated tax system, create sustainable development through a reinvestment rate, better calculate the long tail ROI of private-public investment, determine the contributing economic factors of some institutions, etc...)

5.Lockdowns of COVID-19 Variants.

6.High levels of debt (Something we should work on. Two philosophies...create a better economic mousetrap and the other is to cut our budgets as a way out of it. Similar in struggling businesses. To me we build a better economic system and then cut wasted fat out of programs through ethics, metrics, and performance. If something isn't working find new alternatives and adapt institutions to enhance the larger economic system. Such improvement concepts can apply to almost anything that ranges from medical care to farming. Its a process of continuous tweaking policies without all the ideological poo poo that doesn't allow for constructive change.)

7.Geopolitical issues (Russia-Ukraine, Hyper-Politics in the US, etc....These are risks our politicians should keep in mind.)

8.Natural Disasters (Floods, droughts, etc...)

9.Pricing revisions for technology sector (The volatility might be an indication of upcoming changes that lead into the Digital Era. It should be remember that it is a period of transition and not just a single transition point. We will debate privacy rights, new companies emerging on the market, old companies going bust, and the its part of the total process of transformational change through creative destruction. See Schumpeter.)

Reading reports like this to try and understand the global markets and how that impacts my country and the theory I'm working on.

January 2022 IMF report 'Rising Caseloads, A Disrupted Recovery, and Higher Inflation'

|

| Source IMF January 2022 |

No comments:

Post a Comment